Straight line method of depreciation example

Over time this value will decrease. The DDB rate of depreciation is twice the straight-line method.

Depreciation Methods Principlesofaccounting Com

Given data Purchase price P.

. To calculate straight-line depreciation. The DDB rate of depreciation is twice the straight-line method. A straight-line method of depreciation requires a fixed amount of depreciation to be charged on the assets every year.

Straight Line Depreciation is a depreciation method used to calculate an assets value that reduces throughout its useful life. Straight Line Method of Depreciation - Example. The straight-line depreciation method considers assets used and provides the benefit equally to an entity over its useful life so that the depreciation charge is equally annually.

Now lets consider a full example of a finance lease to illustrate straight-line depreciation expense. You then find the year-one. Using the straight-line depreciation method a company will allocate the same percentage of an assets value for each accounting period.

When you set up a fixed asset. The straight-line depreciation method is the most convenient. Subtract the expense from the beginning book value to arrive at the ending book value.

Straight-line depreciation with a finance lease. The asset in this example cost 80000 was acquired on the first day of the income year and has an effective life of five years. Determine the depreciation charge and book value at the end of 6th year using the straight line method of depreciation.

For example 25000 x 25 6250 depreciation expense. The deduction amount is simply. Straight-Line depreciation is the depreciation method that calculated by divided the assets cost by the useful life.

200000 Salvage value F. This method is also. In our example the.

Straight Line Basis. Expected residual value is the value of a long-lived asset when its useful life is over. Straight line depreciation method charges cost evenly throughout the useful life of a fixed asset.

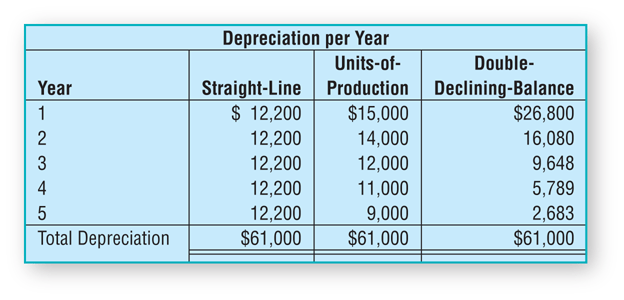

The straight line depreciation method is the most commonly used method for. There are 3 basic methods of depreciation and amortization. This depreciation method is appropriate where economic benefits from an asset are expected.

Merits of Straight Line Method. In year one you multiply the cost or beginning book value by 50. In accountancy it is.

With a straight line depreciation method Salvage value 0 Original price 15000 Depreciating amount each year 15000 - 0 5 3000 However the company realizes that the equipment. Depreciation Value of Asset Salvage Value Life of Asset Value of asset is the value at which the. What is Straight Line Method of Depreciation.

Assets cost are allocated to expense over their life time the expenses. The business uses the following formula to calculate the straight-line depreciation of the printer. Example of Straight Line Depreciation.

This is known as straight line depreciation rate that can be applied to the total depreciable cost to calculate the depreciation expense for the period. Straight-line is a depreciation method that gives you the same deduction year after year over the assets useful life. Formula for calculating Straight line depreciation method is as under.

Price of acquiring the printer 500 - approximate salvage value 50 450. Example of Straight Line Depreciation Method.

Straight Line Method For Calculating Depreciation Qs Study

Straight Line Depreciation Accountingcoach

What Is The Straight Line Depreciation Formula How To Calculate Straight Line Depreciation Video Lesson Transcript Study Com

Depreciation Expense Double Entry Bookkeeping

Straight Line Depreciation Formula Guide To Calculate Depreciation

Method To Get Straight Line Depreciation Formula Bench Accounting

Depreciation Straight Line Method Or Original Cost Method Lecture 2 Youtube

What Is Straight Line Depreciation Method Pmp Exam Youtube

Depreciation Methods Straight Line Sum Of Years Digits Declining Balance Calculations Youtube

Straight Line Depreciation Schedule Calculator Double Entry Bookkeeping

Straight Line Depreciation Accountingcoach

Depreciation Formula Calculate Depreciation Expense

What Is The Straight Line Depreciation Formula How To Calculate Straight Line Depreciation Video Lesson Transcript Study Com

How To Calculate Straight Line Depreciation Depreciation Guru

Straight Line Depreciation Formula And Calculation Excel Template

Straight Line Depreciation Double Entry Bookkeeping

Depreciation Methods Formulas Examples